The 30-year fixed mortgage rate remains high but has noticeably declined in recent months, dipping below 6.5% since mid-August 2024. This prompts the question: What interest rate will finally make homebuyers in each state take the plunge on buying a new home?

We surveyed over 3,200 prospective homebuyers across the U.S. to answer this burning question. We also explored how many homebuyers would lock in a higher rate now with the intention to refinance later. By analyzing these key factors, we’ve uncovered important financial benchmarks guiding Americans today.

Ready to find out what it would take to get people to buy? Let’s take a look.

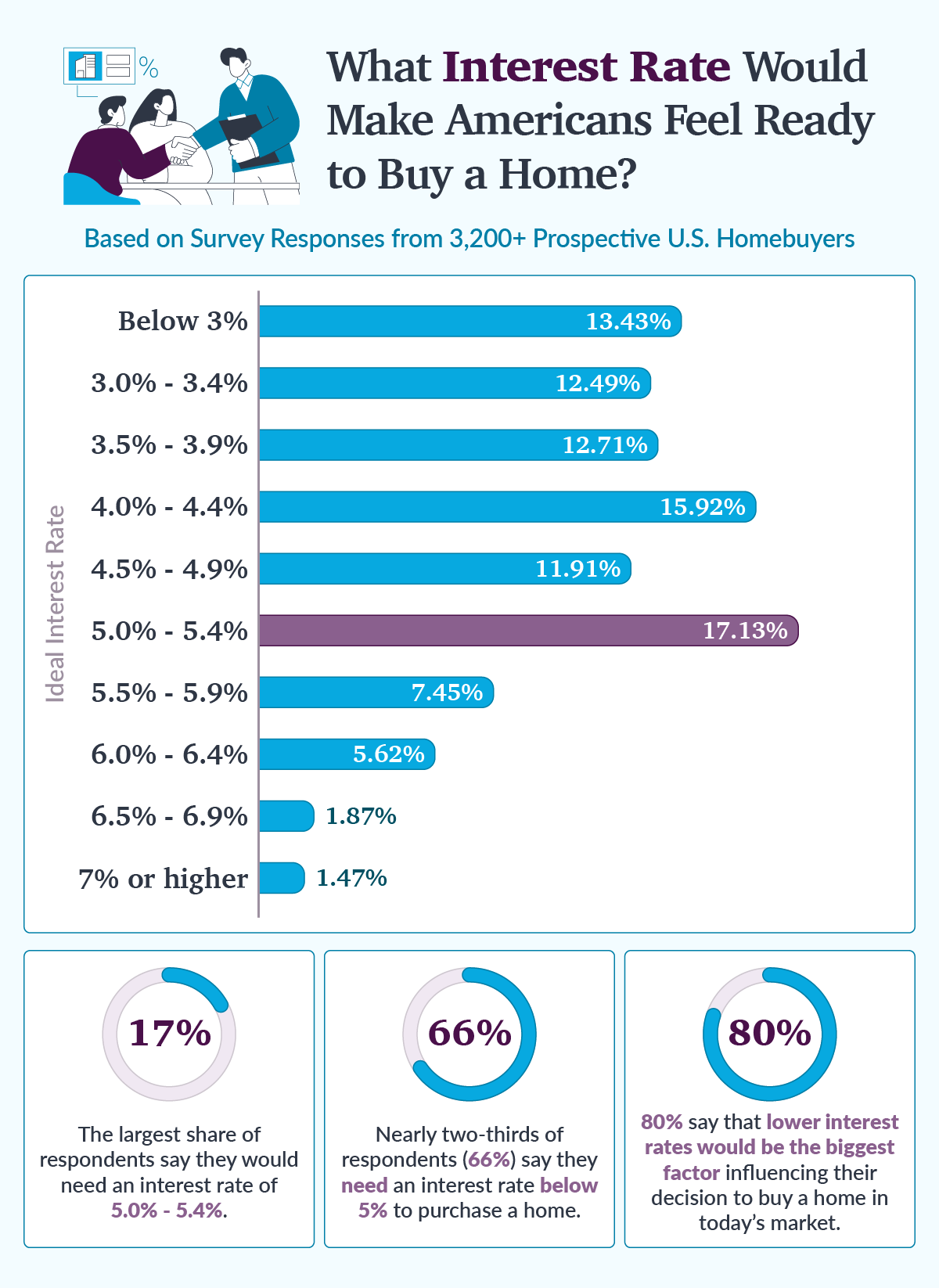

With mortgage rates fluctuating between 6.0% and 7.5% over the past year, it’s no surprise that most homebuyers have been hesitant to jump into the market. Our survey reveals that only 9% of prospective homebuyers would feel comfortable buying a home at current rates, highlighting just how much borrowing costs are weighing on purchasing decisions. The largest share of homebuyers are eyeing a range between 5.0% and 5.4%. Moreover, nearly two-thirds of homebuyers (66%) are holding out for an interest rate below 5% before taking the plunge.

The generational divide is even more striking: Baby Boomers require the lowest rates, needing to see interest fall to between 3.5% and 3.9% to feel confident in making a purchase. For context, the last time rates were below 4% was in March 2022. Meanwhile, Gen Xers are aiming for a slightly higher range of 4.0% to 4.4%. Younger buyers, including Millennials and Gen Zers, are willing to settle for rates in the 5.0% to 5.4% range.

When we asked homebuyers which factors would most influence their decision to buy a home in today’s market, here’s how they weighed in:

- Lower interest rates - 80%

- Decrease in home prices - 68%

- Increase in income - 61%

- More available homes in my price point - 55%

- Larger down payment savings - 33%

- Better job security - 26%

For 80% of respondents, lower interest rates would be the biggest factor pushing prospective homebuyers toward homeownership, underscoring how critical rate sensitivity is in today’s housing market.

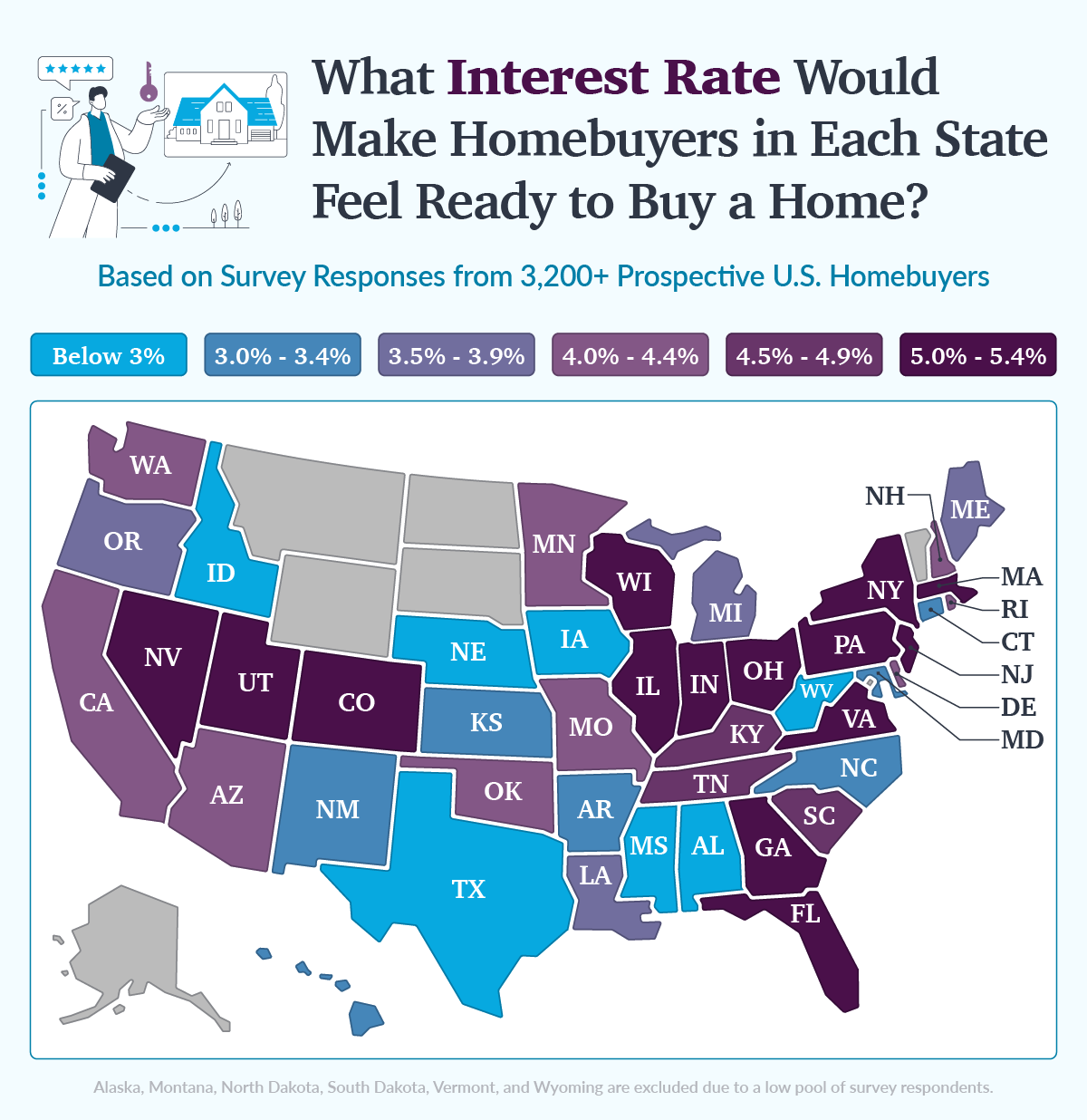

What Interest Rate Would Make Homebuyers in Each State Feel Ready to Buy a Home?

Across the U.S., homebuyers’ expectations for interest rates vary widely by state, reflecting regional differences in financial comfort zones. Prospective buyers in states like Alabama, Idaho and Texas are holding out for the lowest interest rates, with the majority only comfortable purchasing if rates drop below 3%.

Here is the complete list of states where homebuyers are waiting for interest rates to drop below 3% before purchasing a home:

- Alabama

- Idaho

- Iowa

- Mississippi

- Nebraska

- Texas

- West Virginia

On the other hand, in high-cost states like California and New York, buyers are willing to commit at higher interest rates, around 5.0% to 5.4%. These discrepancies highlight how local market dynamics and affordability influence buyer sentiment. Similarly, larger states like Colorado, Georgia, Florida, Illinois and Pennsylvania are willing to move forward with rates in the 5.0% to 5.4% range.

Current vs. Target Interest Rates for Current Homeowners Looking to Buy Again

We also analyzed the ideal interest rates current homeowners, specifically, would need to feel comfortable purchasing a new home and compared them to their existing mortgage rates. Surprisingly, in 16 out of 50 states, many homeowners would settle for higher interest rates than what they currently have. For instance, in New Jersey, homeowners are willing to settle for rates between 5.0% and 5.4%, even though their average locked-in rate is 3.4%. Similarly, in Arizona, many are open to rates around 5.0% to 5.4% despite an existing average rate of 4.4%. When asked about locking in a higher rate now with plans to refinance later, most homeowners in both states said “yes.”

Homeowners may be willing to take on higher rates now out of concern that inventory will tighten even further once rates drop, creating fierce competition for fewer homes. Many are also betting on the potential for future rate cuts, anticipating they can refinance later when conditions improve, making the initial rate less of a long-term concern.

Here’s the complete list of states where homeowners are willing to accept higher interest rates than their current ones, with plans to refinance later:

- Arizona

- California

- Connecticut

- Georgia

- Louisiana

- Nevada

- New Jersey

- New York

- Pennsylvania

On the other end of the spectrum, some states are targeting significantly lower rates than what homeowners currently have. In Iowa, for example, homeowners are aiming for rates below 3% despite being locked in at an average of 4.4%. Similarly, in West Virginia, many are holding out for sub-3% rates even though their current mortgages hover around 4.5%.

Would Americans Consider Locking In At a Higher Rate Now & Refinancing Later?

The decision to lock in at a higher rate now and refinance later divides U.S. homebuyers, with 55% saying they are unwilling to take that risk, while 45% remain open to the strategy. Interestingly, younger generations are driving much of this willingness, as 49% of Millennials and Gen Zers are open to the idea of refinancing, compared to just 38% of Gen Xers and 35% of Baby Boomers. This generational split suggests that younger buyers may have a greater appetite for risk, betting on future rate drops to make refinancing worthwhile.

On a state-by-state basis, prospective homebuyers in 13 states, including Arizona, California and Ohio, are more bullish on this approach, saying “yes” to locking in a higher rate now and refinancing later. Meanwhile, states like Rhode Island and Washington are evenly split on the matter. Overall, prospective buyers in most other states, including Florida and Texas, remain hesitant, preferring to wait for more favorable conditions before making a move.

Closing Thoughts

This study underscores just how much interest rate fluctuations are influencing today’s real estate decisions, revealing that most prospective U.S. homebuyers are playing a waiting game until rates become more favorable. While some may be willing to purchase a new home at today’s rates, the majority of homebuyers are holding out for rates between 5% and 5.4%. If rates keep trending down like they have been, that ideal range might be closer than we think!

"Our survey highlights that, while buyers are paying close attention to interest rates, they're also eager to take action when the right opportunity arises. That's why our mission is to empower buyers with innovative and timely resources—like the ability to purchase online or get support from one of our affiliate services—making it easier for them to find the home of their dreams without compromising financial peace of mind."

These insights are crucial for understanding what drives buyers in today’s market. As a leading homebuilder, Century Communities is uniquely positioned to help buyers navigate this uncertainty with tailored guidance and flexible options, making homeownership more attainable, even in challenging conditions. Ready to find a home that fits your financial goals? Start your home search today.

Methodology

To determine what interest rates would encourage Americans to buy a home, we surveyed 3,255 prospective U.S. homebuyers across 44 states, covering a wide range of demographics. The participants included previous and current homeowners interested in purchasing again as well as first-time homebuyers interested in purchasing a home soon. The survey was conducted between August 30 and September 10, 2024. The following states were excluded due to limited survey responses: Alaska, Montana, North Dakota, South Dakota, Vermont, and Wyoming.