Whether you’re a first-time homebuyer or purchasing a new property, an appraisal is an essential step in your home-buying journey. Home appraisals are third-party valuations that allow lenders to ensure a property is worth the amount they are willing to loan you. This valuation is completed during due diligence just before the lender begins underwriting your loan.

This article explores new construction appraisals, which are specific types of due diligence appraisals used to assess the value of a new construction home. While new construction appraisals are similar to standard home appraisals in many ways, they also have unique characteristics that set them apart.

What Is a New Construction Appraisal?

New construction appraisals evaluate the value of a new home build and can occur after a builder finishes a property or during construction (more on this later). Lenders use appraisal reports to decide whether or not to approve a loan based on a property’s loan-to-value ratio (LTV).

You can easily calculate the LTV ratio of a home by dividing the loan amount by the property value represented in the appraisal report. For example, if a homebuyer attempts to take out a $500,000 loan on a property with an estimated value of $500,000, their LTV is 100%.

Lenders typically approve loans with an LTV of 80% or lower. However, this is not a steadfast rule. Every loan process is different, and new construction appraisals are just one, albeit crucial, factor lenders use to assess the risk associated with a loan. Homebuyers can also lower their LTV by purchasing a portion of the property with cash. Using the scenario we previously discussed, the home buyer could put down $100,000 themselves, lowering their loan to $400,000 and their LTV to 80%.

How Home Appraisals Work

While each home appraisal will be different based on the characteristics and amenities a property possesses, home lenders usually look at the following factors to determine the value of a home:

Square footage: How large is the home?

Lot size: How large is the land the home is on?

Condition: What condition is the home's foundation, roof, walls, and other features in?

Upgrades: Has the previous owner made any renovations or notable additions?

Number of rooms: How many bedrooms and bathrooms does the home have?

Amenities: Does the home possess any notable amenities? Pool? Fireplace?

Quality of location: What neighborhood is the home in?

Market conditions: What have comparable properties recently sold for?

Home appraisals can take one to four weeks, depending on the number of factors considered and the complexity of assigning a value to these factors.

Certain home loans, especially those backed by the Federal Housing Administration (FHA loans) or the U.S. Department of Veterans Affairs (VA loans), sometimes require more complex appraisals. Appraisers may need to assess additional factors, such as the current state of a home’s appliances and utility systems.

How Are New Construction Appraisals Different from Existing Homes?

New construction appraisals differ from standard appraisals in a few ways. During a new construction appraisal, it's standard practice to use a cost-based valuation method instead of the value-based method used to evaluate existing homes.

The cost approach method determines the overall value of a new construction project by assessing the overall cost of the land and the materials it will take to build the house. Cost-based appraisals are commonly used for new construction properties because the costs associated with construction are well documented and readily available.

In contrast to cost-based appraisals, value or sales-based appraisals use market data and recent sales to evaluate the value of a property. Appraisers commonly use sales-based appraisals for existing homes.

What type of appraisal is used for new construction?

What type of appraisal is used for new construction?

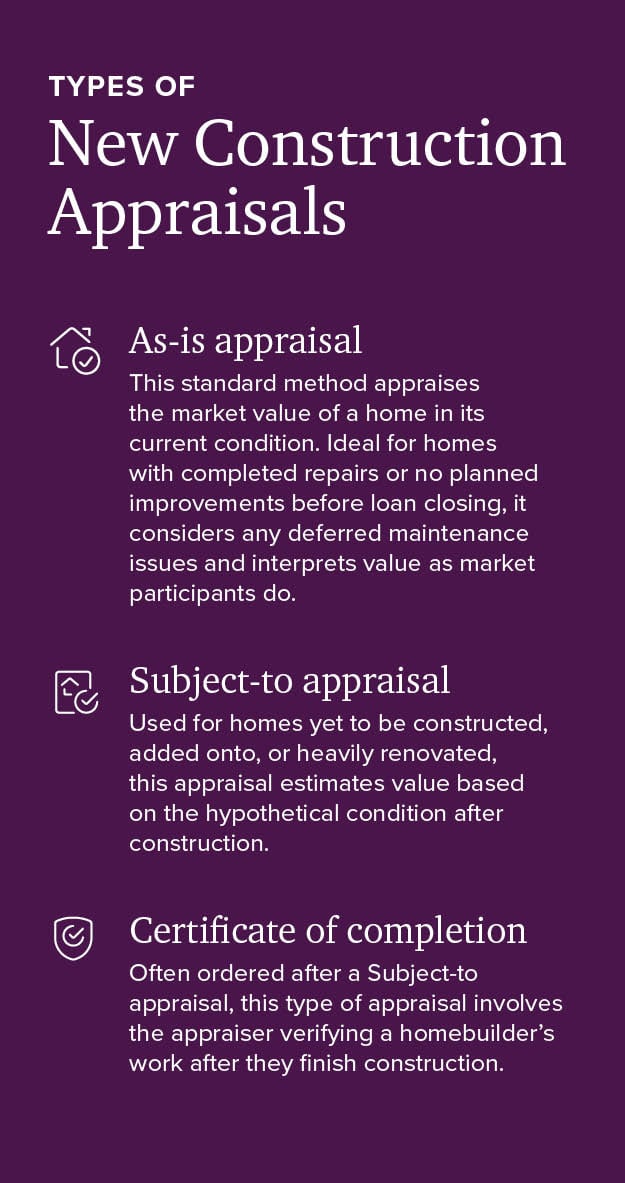

When appraising new construction, appraisers use three primary methods to determine the property's value: as-is appraisals, subject-to appraisals, and certificates of completion. Each method suits properties in different stages and conditions ensuring an accurate assessment based on a new construction project’s current or future state.

As-is appraisal: This standard method appraises the market value of a home in its current condition. Ideal for homes with completed repairs or no planned improvements before loan closing, it considers any deferred maintenance issues and interprets value as market participants do.

Subject-to appraisal: Used for homes yet to be constructed, added onto, or heavily renovated, this appraisal estimates value based on the hypothetical condition after construction. It requires blueprint plans and specifications and projects the home's value once all planned work is complete.

Certificate of completion: Often ordered after a Subject-to appraisal, this type of appraisal involves the appraiser verifying a homebuilder’s work after they finish construction. The appraiser revisits the property, ensuring the work meets original specifications and providing an adjusted home value that is valid once all construction is complete.

How is an appraisal completed when a home is still being constructed?

When an appraiser completes a home appraisal during construction, they will collect documentation from the home builder to determine the property's final value.

A home appraiser may request various documents, including blueprints, material lists, a spec sheet with an overview of the number of features (bedroom, bathrooms, windows, etc.) the home will possess, and a breakdown of associated cost estimates (land, construction materials, labor, etc.).

Why are appraisals necessary for new construction homes?

Appraisals are critical to the home-financing process, whether for an existing or new construction home. In the case of a new construction home, an appraisal enables lenders and homebuyers to gain a third-party valuation of the property. This valuation is important because it helps both parties determine the LTV ratio and assess the risk associated with the loan.

Common Challenges of New Construction Appraisals

New home appraisals can present several unique challenges compared to appraising existing properties. Here are some common challenges to be aware of:

Lack of comparable sales: If a new construction build is part of a new development, it can be difficult for an appraiser to find similar homes and comparable sales to accurately determine the build's market value.

Assessing construction quality: Evaluating the quality of construction, materials, and craftsmanship requires expertise, and there can be a wide variation in quality, even among new homes.

Incomplete projects: Appraising homes that aren't fully completed or are still under construction adds uncertainty, as future work and final finishes need to be estimated.

Market fluctuations: New construction can take a long time from start to finish, and market conditions can change during this period, affecting property values.

Builder incentives and upgrades: Builders often offer buyers incentives, upgrades, or eco-efficient features, which might not directly translate to increased value.

Future development: The potential for future development in the area can affect the appraisal, as new infrastructure or amenities can increase future values.

Subjectivity: There is often a subjective element in appraisals, and different appraisers might arrive at different values for the same property.

One Step Closer to Your Dream Home: New Construction Appraisals

After an appraiser completes their report, you and your lender will receive a copy, including the build’s valuation and the research the appraiser used to determine the appraised value.

Appraisals for new construction homes from Century Communities are straightforward due to our community's strong reputation. Lenders trust our partnership with reliable builders who deliver high-quality homes on schedule and within budget, eliminating typical loan contingencies. We’re here to help you locate and move into your dream home faster.

New Construction Appraisals FAQ

Is one new construction appraisal enough?

In most cases, a single appraisal is sufficient to determine the value of a new construction build accurately. However, if there is a significant difference between the appraiser's evaluation and the property's listing price, or if you believe the appraiser underestimated the build’s value, you may want to request a second evaluation.

What happens when a new build doesn’t appraise well?

When a new home build doesn't appraise, you have several options based on various scenarios and conditions:

Request the seller to lower their asking price: The seller may decide to reduce their asking price to get the loan approved.

Challenge the appraisal: You or the seller may challenge the appraisal based on a second opinion or inconsistencies in the report.

Appeal the appraisal: Based on your challenge, the lender may allow you to appeal the assessment, asking the original appraiser to reconsider their valuation.

Increase your down payment: The lender may accept the appraisal even after you challenge or appeal the report. In this case, you may need to increase your down payment to get the loan approved.

What type of appraisal is used for new construction?

In general, lenders request three types of appraisals for new construction properties: as-is appraisals, subject-to appraisals, and certificates of completion.

When is the appraisal conducted on a new construction home?

Home appraisals for new construction typically take one to four weeks and are usually completed by an appraiser as a part of a lender’s due diligence just before underwriting begins.

Who pays for an appraisal on new construction?

It’s standard practice for homebuyers to pay for an appraisal for a new construction home. The appraisal is often included in the buyer’s closing costs and is one of the top expenses first-time homebuyers should consider.

What can I do after my new construction appraisal?

After a new construction appraisal, there are several ways you can proceed based on the appraiser’s valuation:

New construction appraisal lower than builder price: You can negotiate a lower purchase price with the seller, appeal the appraisal with your lender, or request a new appraisal (using similar properties and recent sales as evidence and justification to undergo a new appraisal process).

New construction appraisal higher than builder price: You can potentially request a higher loan amount and decrease your down payment while keeping the same LTV.

The new construction appraisal is just one step of your journey to being a homeowner. You can begin that journey with us today by taking the first step toward your own beautiful new-construction home.